How to save money fast on a low income seems impossible when you’re earning ₹15,000 to ₹25,000 per month, right? Between rent, EMIs, family responsibilities, and the daily rising prices of everything, saving even ₹1,000 feels like a dream. You’re not overspending on fancy restaurants or foreign trips—you’re just trying to manage month-end without borrowing.

But here’s the truth: You can save money even on a low income in India. You need strategies that work for our reality—not advice copied from American websites. This guide shows you exactly how to save money fast on a low income using methods designed for Indian salaries, expenses, and culture.

Let’s start with what actually works for us.

Why Saving Money Feels Impossible on Low Salary (The Indian Reality)

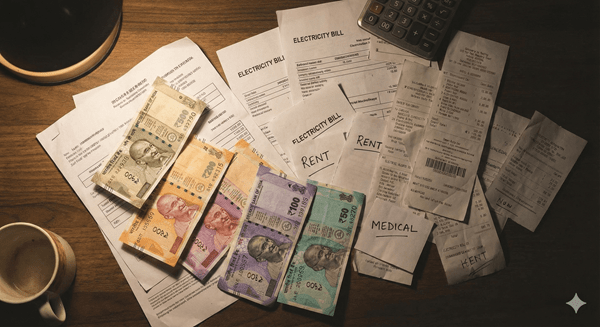

Traditional savings advice says “save 30% of income.” When you earn ₹20,000 monthly and pay ₹8,000 rent, ₹3,000 for groceries, ₹2,000 for transport, ₹1,500 mobile/internet, and send ₹2,000 home—where’s the 30%? This advice comes from people who’ve never lived on a tight budget.

The Indian reality includes extra pressures. Family obligations aren’t optional. Festivals mean expenses. Medical emergencies for parents fall on you. Marriage pressure creates financial stress. You’re not just managing your own money—you’re managing family expectations too.

But here’s the shift: Saving isn’t about the amount—it’s about the habit. Even ₹500 monthly is ₹6,000 yearly. That’s your emergency fund starting. It’s your “I don’t need to borrow from friends” money. It’s your dignity and peace of mind.

Most people wait for salary increases to start saving. That day never comes because expenses rise with income. The only way forward is starting now with ₹20, ₹50, or ₹100—whatever you can manage—and building from there.

How to Budget Money on Low Income: The Indian Way

How to budget money on low income needs a system that works with Indian payment habits. Forget complex Excel sheets. Here’s what works:

Try These Best Earning Apps in India

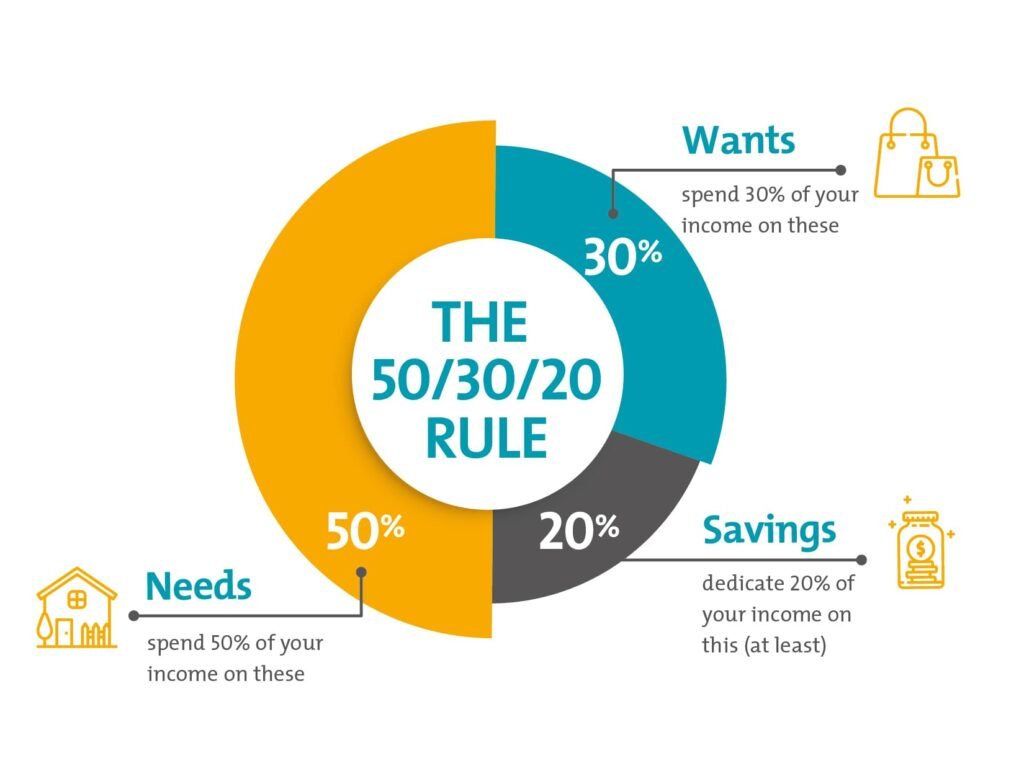

The 50/30/20 rule modified for India: Try 60% needs, 25% wants, 15% savings. On ₹20,000 salary: ₹12,000 for rent/groceries/transport, ₹5,000 for eating out/clothes/entertainment, ₹3,000 for savings. Can’t do 15%? Start with 10% (₹2,000) or even 5% (₹1,000).

Track every rupee for one month. Use apps like Walnut, Money Manager, or just a notebook. Write down: chai (₹10), auto (₹50), recharge (₹200), everything. You’ll be shocked where money disappears. Most people waste ₹2,000-3,000 monthly on forgotten expenses.

Set up automatic savings immediately. Tell your bank to transfer ₹500 (or whatever amount) to your savings account on salary day itself. What you don’t see, you don’t spend. This is the single most powerful trick for how to save money with low income. Altertaively you can also try SIP for small amount for good return.

Use digital envelopes. Create separate bank accounts or UPI IDs for different purposes: Bills (rent, electricity), Daily (food, transport), Savings (emergency fund). Transfer money on payday and stick to each envelope. When daily expenses envelope is empty, you’re done spending.

Cut Monthly Expenses Without Sacrificing Lifestyle

You’re already living lean, so let’s find smart cuts that don’t hurt:

Mobile and internet: Are you paying ₹500+ monthly? Switch to annual prepaid plans (₹2,400/year = ₹200/month). Cancel OTT subscriptions you barely use—Netflix, Prime, Hotstar together cost ₹1,000+ monthly. Keep one, share with family.

Electricity bill cuts: LED bulbs save ₹200-300 monthly. Switch off AC one hour earlier (set timer). Iron clothes together once weekly instead of daily. Unplug chargers and appliances—standby mode wastes ₹150-200 monthly.

Grocery shopping smartly:

- Buy from local sabzi mandi, not supermarkets—saves 30-40%

- Purchase monthly staples (rice, dal, oil) in bulk during sales

- Reduce outside food from 10 times monthly to 5 times—saves ₹1,500

- Cook larger quantities and use leftovers creatively

Transportation savings: Can you take the bus instead of auto for daily commute? That’s ₹100-150 saved daily = ₹3,000 monthly. If you ride a bike, proper tire pressure and timely servicing saves ₹300-500 on petrol monthly.

Eliminate subscription creep: Check bank statements for auto-debits. That gym membership you don’t use? Cancel it. Magazine subscriptions? Stop them. Every ₹200 saved is ₹200 earned.

One big trick: Implement a 48-hour rule for non-essential purchases over ₹500. Want new shoes? Wait 2 days. 70% of the time, the urge passes and you’ve saved money by doing nothing.

See Also: How to Pick Best Credit Card

How to Save Money Fast on a Low Income: Start with ₹500

This is where how to save money fast on a low income becomes real action, not just talk.

The ₹20 daily challenge: Can you save just ₹20 daily? Skip one chai-samosa (₹30), keep ₹20. That’s ₹600 monthly or ₹7,200 yearly. Sounds small? It’s bigger than what 60% of Indians have in emergency savings.

Open a Recurring Deposit (RD): Go to your bank and start an RD of ₹500 or ₹1,000 monthly. It auto-debits from your account, and you can’t touch it easily. After 12 months, you’ll have ₹6,000-12,000 plus interest. This forced saving works brilliantly for those who struggle with discipline.

Use round-up savings: Some apps like Jupiter or Fi round up every UPI payment to the nearest ₹10 and save the difference. Spent ₹47? It becomes ₹50, and ₹3 gets saved. You’ll barely notice but save ₹500-800 monthly automatically.

Save bonuses immediately: Got Diwali bonus, birthday money, or tax refund? Save 100% of it before you spend anything. This “found money” doesn’t feel real, so it’s easiest to save. Even a ₹5,000 bonus twice yearly adds ₹10,000 to emergency fund.

The jar method: Keep a jar at home. Every night, empty coins and small notes from your pocket/purse into it. At month-end, deposit it—usually ₹300-600 magically appears.

Increase Income Through Indian Side Hustles

If you can add even ₹3,000-5,000 monthly, your savings journey accelerates dramatically. Here are realistic options:

Best Side Hustle in India: Start Earning Today (2026)

Gig economy works:

- Delivery partner (Swiggy, Zomato, Dunzo): Earn ₹5,000-10,000 working evenings/weekends

- Rapido bike taxi: If you have a two-wheeler, earn ₹300-500 daily on your own schedule

- Urban Company services: If you have skills (cleaning, repair, beauty), register as a partner

Teaching never goes out of style:

- Home tuitions: Even 2-3 students at ₹1,500 each = ₹4,500 monthly

- Online tutoring: Platforms like Vedantu, Unacademy pay per class

- English conversation partner: Many apps pay ₹200-300 per hour

Digital earning:

- Content creation: YouTube shorts, Instagram reels can earn after you build audience

- Freelancing: Writing, graphic design, data entry on Fiverr, Upwork, Truelancer

- Reselling: Buy wholesale from local markets, sell online with markup—many earn ₹5,000-15,000 monthly

Monetize what you have:

- Extra room? List on Airbnb or get a paying guest (₹5,000-8,000)

- Car sitting idle? Rent on Zoomcar (₹10,000-20,000 monthly)

- Good at cooking? Sell tiffin services to bachelors/working people nearby

You don’t need to work 18 hours daily. Even one side hustle bringing ₹3,000 monthly doubles your savings capacity if you were saving ₹3,000 before.

Build Emergency Fund of ₹10,000-20,000 First

How to budget and save money on a small income starts with one goal: emergency fund.

Target: ₹10,000-20,000. Not ₹5 lakhs. Not one year’s expenses. Just enough to handle medical emergency, bike repair, or job loss for 1-2 months without borrowing or using credit cards.

Why this matters: Without savings, every emergency becomes a crisis. You take personal loans at 18-24% interest. You borrow from friends and feel embarrassed. You’re stuck in survival mode forever. Emergency fund breaks this cycle.

Timeline: Save ₹2,000 monthly = ₹10,000 in 5 months. Can’t do ₹2,000? Save ₹1,500 monthly = ₹10,000 in 7 months. The timeline matters less than starting.

Where to keep it:

- Savings bank account with different bank (not your salary account)—easy access but separate

- Liquid mutual fund if you can wait 1-2 days for withdrawal—earns 6-7% vs. 3-4% in savings account

- Fixed Deposit with premature withdrawal allowed—earns more but takes effort to break

Label it “Emergency Only” in your mind. Only real emergencies qualify: medical, job loss, critical repairs. New phone launch is NOT an emergency.

Once you hit ₹10,000-20,000, celebrate genuinely. You now have financial security that most Indians don’t. You’re not one crisis away from disaster.

Avoid Financial Traps Common in India

These traps destroy savings and keep you broke:

Personal loans and credit cards: That ₹50,000 personal loan at 18% interest costs you ₹9,000 yearly in interest alone. Credit cards charging 36-42% APR are worse. If you carry ₹30,000 balance, you pay ₹12,000+ yearly just in interest. Avoid these unless absolute emergency.

Buy Now Pay Later (LazyPay, Simpl, ZestMoney): Seems convenient but encourages overspending. You buy things you can’t afford, then struggle with EMIs. If you can’t pay full amount today, don’t buy it.

Chitfunds and risky schemes: Your neighbor’s cousin’s “guaranteed return” plan will disappear with your money. Stick to bank RDs, PPF, or established mutual funds only.

Unnecessary insurance: Agents will sell you endowment plans, money-back policies, ULIP—all give pathetic returns of 4-6%. You need only term insurance (if you have dependents) and health insurance. Nothing else.

Hidden charges everywhere: ATM fees (₹20 per transaction), late payment charges, minimum balance penalties—these drain ₹2,000-3,000 yearly silently. Use your bank’s ATM, set reminders for bill payments, maintain minimum balance.

Lifestyle inflation: Got ₹2,000 raise? Don’t immediately upgrade phone plan or eat out more. Save that ₹2,000 entirely. Your lifestyle hasn’t adjusted yet—lock in the savings before expenses rise to meet income.

Conclusion

How to save money fast on a low income in India isn’t about complex strategies—it’s about starting small, staying consistent, and avoiding traps. You’ve learned how to budget realistically, cut expenses smartly, save using Indian methods, increase income through side hustles, and build your first emergency fund.

Your action step today: Transfer ₹100 to a separate savings account right now. That’s it. Tomorrow, decide your monthly savings amount, but today—just start. Open that RD. Download a tracking app. Transfer that first ₹100.

See Also: Best UPI Apps for India

You can do this. Thousands of Indians on similar salaries are building savings right now. Join them.

FAQ Section

Q: How much should I save on ₹20,000 salary?

A: Start with whatever you can manage consistently—even ₹500-1,000 (5%) monthly. As you get better, aim for ₹2,000-3,000 (10-15%). First goal: build ₹10,000 emergency fund in 6-10 months.

Q: Should I save or pay off loans first?

A: Do both. Save ₹500-1,000 monthly for emergency fund while paying extra ₹500-1,000 toward high-interest debt. Having zero savings makes you take more loans when emergencies hit.

Q: Which is better: RD, FD, or mutual funds for saving?

A: For emergency fund (0-6 months goal): use savings account or liquid mutual funds. For 1-3 year goals: use RD or FD. For 5+ years: consider mutual funds through SIP after emergency fund is ready.

Q: How to save when sending money home to parents?

A: Talk to family honestly. Reduce home contribution by ₹500 and start saving it. Most understanding parents prefer you build security than send every rupee. Or increase income through side hustle so you can do both.

Q: Is ₹10,000 emergency fund really enough?

A: For starting, yes. It handles most common emergencies in India (doctor visit ₹2,000-3,000, bike repair ₹3,000-5,000, minor crisis ₹8,000-10,000). After reaching ₹10,000, aim for ₹50,000 as next goal. Progress, not perfection.

Next Read: