Why Understanding Digital Money Transfers Matters

Remember the days when transferring money meant standing in long bank queues, filling out multiple forms, and waiting days for the transaction to complete? Those days are thankfully behind us.

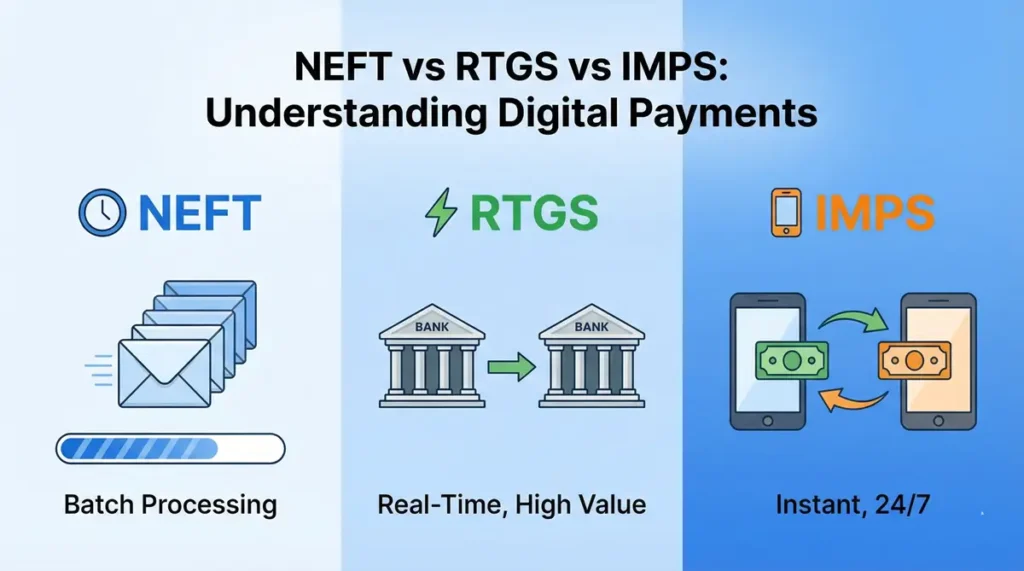

Today, sending money across India is as simple as a few taps on your smartphone. But here’s where many people get confused: should you use NEFT, RTGS, or IMPS? Each method has its own strengths, and choosing the wrong one could mean unnecessary delays or charges.

As someone who’s been writing about finance technology for over a decade, I’ve seen countless people struggle with this choice. The good news? Once you understand the basics, picking the right transfer method becomes second nature.

In this guide, I’ll break down these three types of bank transfer in India in the simplest way possible. Whether you’re a student sending money home, a freelancer receiving payments, or a business owner making supplier payments, you’ll know exactly which method to use by the end of this article.

What is NEFT? Your Reliable Batch Transfer System

NEFT stands for National Electronic Funds Transfer. Think of it as the workhorse of Indian banking—steady, reliable, and perfect for most everyday transactions.

How NEFT Works

NEFT processes transactions in batches throughout the day. Imagine a bus service that picks up passengers every 30 minutes. Your money joins a “batch” with other transactions and gets processed together. The Reserve Bank of India (RBI) operates these batches in half-hourly settlements.

NEFT Timings and Availability

Here’s the best part: NEFT now operates 24×7, including weekends and bank holidays. This change came into effect in December 2019, making life much easier for everyone. You can initiate a transfer at 2 AM on Sunday if you need to, though settlement might take a bit longer during off-hours.

NEFT Transaction Limits

There’s no minimum amount for NEFT transfers. Want to send ₹10 to your friend? Go ahead. The maximum limit depends on your bank’s policies, but most banks allow transfers up to ₹10 lakhs per transaction through internet banking.

NEFT Charges

Good news: NEFT transactions are completely free for customers. Banks cannot charge you anything for NEFT transfers, making it the most economical option for regular transactions.

Try Our New Home Loan EMI calculator

What is RTGS? When You Need Money to Move Fast

RTGS stands for Real Time Gross Settlement. The name tells you everything: transactions happen in real-time, and each transaction is processed individually (gross settlement).

How RTGS Works

Unlike NEFT’s batch system, RTGS is like taking a private taxi. Your transaction gets individual attention and processes immediately. The money moves from one bank to another in real-time, without waiting for other transactions.

RTGS Availability and Timings

RTGS also operates 24×7 now. However, most banks process RTGS transactions during specific hours (typically between 7 AM and 6 PM on weekdays). Outside these hours, your transaction might get queued for the next working window.

RTGS Minimum Amount and Limits

Here’s the catch: RTGS has a minimum transaction limit of ₹2 lakhs. This makes sense because RTGS is designed for high-value transactions where speed matters. There’s no maximum limit, though individual banks might have their own caps for security reasons.

RTGS Charges

RTGS isn’t free. Banks charge based on transaction size. For transactions between ₹2 lakhs to ₹5 lakhs, you might pay around ₹20-₹25. For amounts above ₹5 lakhs, charges can go up to ₹50. The exact fee varies by bank.

What is IMPS? Your 24×7 Instant Money Transfer Solution

IMPS stands for Immediate Payment Service, and it lives up to its name. This is the instant money transfer India solution that changed the game for urgent payments.

How IMPS Works

IMPS provides immediate interbank electronic fund transfer through mobile phones, internet, and ATMs. It’s built on the infrastructure of National Financial Switch (NFS) and operates through the National Payments Corporation of India (NPCI).

IMPS: True 24×7 Service

IMPS was the first to offer genuine round-the-clock service, even before NEFT and RTGS adopted 24×7 operations. Whether it’s Diwali night or Republic Day morning, IMPS works without a break.

IMPS Transaction Limits

You can transfer as little as ₹1 through IMPS. The maximum limit is typically ₹5 lakhs per day, though this varies by bank and your account type. Some banks allow up to ₹10 lakhs for premium accounts.

IMPS Charges

IMPS charges are minimal but exist. Most banks charge ₹2-₹5 for transactions up to ₹10,000, and ₹5-₹15 for higher amounts. These charges are small compared to the convenience you get.

NEFT vs RTGS vs IMPS: Complete Comparison Table

| Feature | NEFT | RTGS | IMPS |

|---|---|---|---|

| Transfer Speed | 2-3 hours (batch processing) | Within minutes (real-time) | Instant (within seconds) |

| Settlement Type | Batch settlement | Real-time gross settlement | Immediate settlement |

| Availability | 24×7 (including holidays) | 24×7 (bank hours may vary) | 24×7 (true round-the-clock) |

| Minimum Amount | No minimum (₹1 onwards) | ₹2,00,000 | No minimum (₹1 onwards) |

| Maximum Limit | Bank-dependent (usually ₹10 lakhs) | No maximum | ₹5 lakhs per day (varies) |

| Ideal Use Case | Regular payments, bill payments | High-value business transactions | Urgent small to medium transfers |

| Charges | Free (zero charges) | ₹20-₹50 per transaction | ₹2-₹15 per transaction |

Real-Life Scenarios: When to Use Which Method

Scenario 1: Sending Monthly Support to Parents

You transfer ₹30,000 to your parents on the 1st of every month. Which method should you use?

Best Choice: NEFT

Why? The amount is moderate, timing isn’t urgent (you can do it a day early), and it’s completely free. Since you’re doing this regularly, zero charges make a real difference over time.

Scenario 2: Emergency Money Transfer at Midnight

Your friend met with an accident in another city at 11 PM and needs ₹50,000 immediately for hospital admission.

Best Choice: IMPS

Why? IMPS works 24×7 with instant settlement. Your friend will receive the money within seconds, even at midnight. The small transaction fee is worth the peace of mind.

Scenario 3: Paying ₹15 Lakhs for Property Down Payment

You need to transfer ₹15 lakhs to the builder for your new apartment’s booking by today evening.

Best Choice: RTGS

Why? For such high-value transactions, you want immediate confirmation. RTGS provides real-time settlement, so both you and the builder know the money has arrived. The ₹50 charge is negligible compared to the transaction value.

Scenario 4: Splitting Restaurant Bill with Friends

You need to send ₹450 to your friend who paid the bill yesterday.

Best Choice: NEFT or UPI

Why? NEFT is free and will reach within a few hours. Honestly, though, for such small amounts, UPI might be even more convenient. But if you’re sticking to these three options, NEFT wins.

Pros and Cons: Understanding Each Method Better

NEFT Advantages and Disadvantages

Pros:

- Completely free of charge

- No minimum transaction limit

- Available 24×7 including holidays

- Suitable for all routine transactions

- Widely accepted across all banks

- Easy to use through net banking or mobile apps

Cons:

- Not instant (takes 2-3 hours typically)

- Batch processing means waiting for settlement

- Not ideal for urgent payments

- Transfer time can be longer during weekends

RTGS Advantages and Disadvantages

Pros:

- Real-time settlement within minutes

- Best for high-value transactions

- Individual transaction processing ensures focus

- Immediate confirmation gives peace of mind

- Secure for large amounts

- Available 24×7

Cons:

- Minimum limit of ₹2 lakhs restricts usage

- Transaction charges apply

- Not cost-effective for regular small payments

- Overkill for everyday transactions

IMPS Advantages and Disadvantages

Pros:

- Truly instant transfers (within seconds)

- Works 24×7 without any restrictions

- No minimum limit

- Perfect for emergencies

- Can be done via mobile, internet, or ATM

- Available even during bank holidays

Cons:

- Daily transaction limits (usually ₹5 lakhs)

- Small charges apply

- Slightly more expensive than NEFT

- Not as cost-effective for very large amounts

Which Transfer Method Should You Choose? Your Decision Guide

Making the right choice comes down to three questions:

Question 1: How urgent is the transfer?

- Extremely urgent (emergency): Choose IMPS

- Needed today: Choose RTGS (if amount is above ₹2 lakhs) or IMPS

- Can wait a few hours: Choose NEFT

Question 2: How much are you transferring?

- Below ₹2 lakhs: NEFT or IMPS

- Above ₹2 lakhs: RTGS or IMPS (if within limit)

- Regular small amounts: NEFT (to save on charges)

Question 3: What time is it?

- During banking hours: All three work well

- After hours or holidays: IMPS is most reliable

- Weekend routine transfer: NEFT works fine

Quick Decision Matrix

For most people, here’s the simple thumb rule:

Use NEFT when: You’re making regular, planned payments and can wait a few hours. It’s free and reliable.

Use RTGS when: You’re transferring more than ₹2 lakhs and need immediate confirmation. Perfect for business and property transactions.

Use IMPS when: Every minute counts or you’re transacting outside regular banking hours. Worth the small fee for instant peace of mind.

Frequently Asked Questions (FAQs)

Q1: Can I cancel an NEFT, RTGS, or IMPS transaction after initiating it?

Once the transaction is processed, you cannot cancel it. However, if it’s still pending (showing as “in process”), contact your bank immediately. They might be able to stop it, especially for NEFT.

Q2: Which is safer: NEFT, RTGS, or IMPS?

All three are equally safe as they operate through secure banking channels regulated by the RBI. Always verify the beneficiary’s account details before transferring to ensure your money reaches the right person.

Q3: Why is my NEFT taking longer than usual?

During weekends and holidays, NEFT might take slightly longer due to lower processing frequency. Also, if the beneficiary bank’s systems are down, there could be delays. Typically, even slow NEFT transfers complete within 24 hours.

Q4: Can I use IMPS to transfer money internationally?

No, IMPS only works for domestic transfers within India between Indian bank accounts. For international transfers, you need services like SWIFT or specialized remittance services.

Q5: Is there a daily limit on the number of NEFT transactions I can do?

There’s no RBI-imposed limit on the number of transactions. However, your bank might have internal policies limiting daily transaction counts or total value for security reasons. Check with your specific bank.

Q6: Do I need to add a beneficiary before using these transfer methods?

For NEFT and RTGS through net banking, most banks require you to add and activate the beneficiary first (which can take a few hours). IMPS often allows immediate transfers even without prior beneficiary addition, though adding beneficiaries is always safer.

Try Best Cashback Credit Card in India

Conclusion: Choose Smart, Transfer Confidently

Understanding the difference between NEFT, RTGS, and IMPS transforms you from a confused user to a confident digital payment expert. Each online bank transfer method serves a specific purpose in India’s robust digital banking ecosystem.

Here are your key takeaways:

NEFT is your go-to for regular, non-urgent transfers because it’s free and reliable. RTGS is your heavyweight champion for large, time-sensitive transactions where every minute matters. IMPS is your emergency responder, always ready at any hour for instant transfers.

The beauty of having these three options is that you’re never stuck. Whether it’s sending money to family, paying vendors, or handling emergencies, there’s always a method that fits your exact need.

Remember: choosing the right transfer method saves you both time and money. A ₹50 RTGS charge makes perfect sense for a ₹10 lakh property payment, but not for your ₹500 grocery reimbursement to a friend.

Take a moment today to check which methods your bank offers through their mobile app. Familiarize yourself with the process before you urgently need it. Trust me, when you need to send money at 2 AM during an emergency, you’ll be grateful you know exactly which button to press.

Your next step: Open your banking app right now and explore these transfer options. The best time to learn is before you urgently need to use them. Happy transferring!